Individual Retirement Account

Secure Your Future With An Individual Retirement Account

Don’t let saving for retirement be a drag. See the Rates page for current rates. HTIFCU offers the following IRA options:

Traditional IRA:

Traditional IRA accounts are a great way to save for retirement. You accrue interest on your savings, plus any contributions to this account are usually tax-deferred when deposited, but will be taxed after retirement when withdrawn (check with your tax attorney for clarification).

Call Member Services at 808.942.5115 Ext. 221 for more details

Roth IRA:

Roth IRA accounts work similarly to traditional IRA accounts, with one big difference. Roth IRA account contributions must be declared when you file taxes, but will not be taxed when withdrawn. Roth IRA accounts also yield interest over time.

Call Member Services at 808.942.5115 Ext. 221 for more details

Coverdell IRA:

A Coverdell IRA is also referred to as an Education Savings Account. This type of IRA account is tax advantaged and used to cover future education expenses (for elementary, secondary or college). There is a maximum deposit of $2,000 per year per child.

Call Member Services at 808.942.5115 Ext. 221 for more details

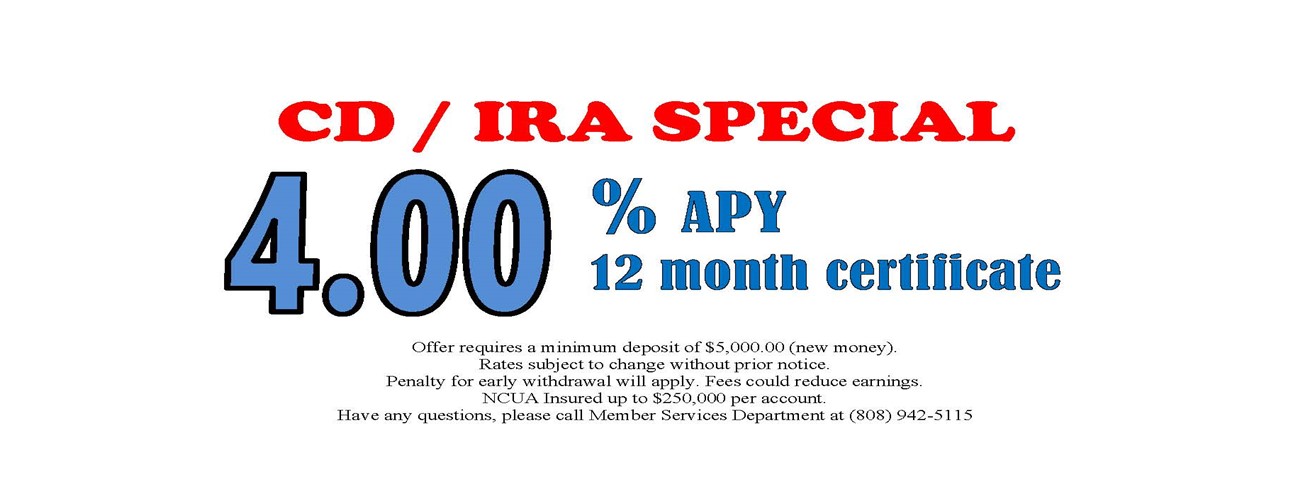

IRA Share Certificates:

HTIFCU also offers IRA Share Certificates which allow you to accrue a higher rate of interest over a short period of time. For more information on Share Certificates, please view the “Certificates” page.

Is an IRA Right For You? Take our Hotel & Travel Industry Federal Credit Union One-Minute IRA Test and find out.

Call Member Services at 808.942.5115 Ext. 221 for more details

*Federally insured by NCUA.